Accounting for sale of NCA

Introduction

Recently I taught someone how to do a sale of NCA question and I didn’t feel like I did a very good job of breaking things down.

After reviewing through my teaching process, here’s how i would cover it this time around.

Let's Practice!

Let’s look at a typical sale of NCA question:

There’s a reason why the question requires you to calculate the depreciation expense before proceeding on to calculate the gain or loss.

Because in order to determine gain or loss, you need to compare the net book value of the NCA compared to the amount you received from the sale.

If we need to look at this in a mathematical formula:

NBV > sales proceeds = loss

NBV < sales proceeds = gain

At this point, it would be good to read the question above to take note of one important piece of information. Pause at this point and take a look again and see if you can spot it. Click on the box below in order to see the hint.

Hint

The question did not state that depreciation is charged in full in the year it was purchased or that no depreciation is to be charged in the year of sale.

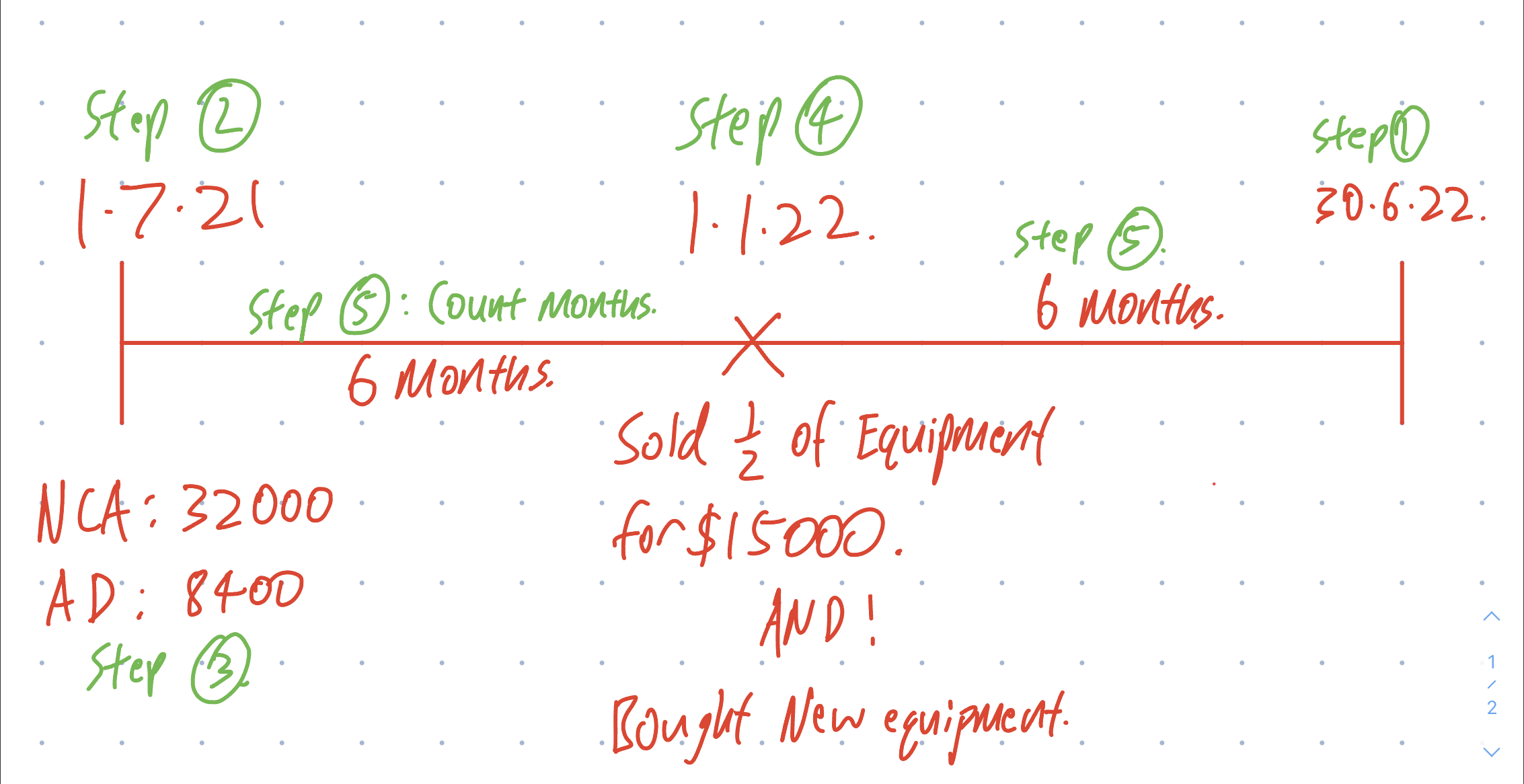

In other words, timing is very important for such a question and you need to draw a timeline to visualise the number of months.

Did you manage to get it? No worries if you didn't, remember to learn from your mistakes and move on :)

Let's resume the question by drawing out the timeline.

You can use the timeline above to visualise the question if you're not too confident. But do try to reread the question and attempt it on your own.

You need to attempt to calculate the following:

- NCA that was sold

- NCA that was used the whole year

- New NCA

Typically questions will involve buying and selling of assets within a year. We are testing to see if you can break down the information into the relevant parts to calculate the depreciation expense and how it will affect accumulated depreciation.

I will break down the different answers that you need to calculate in the toggle boxes below :)

NCA that was sold

[20% x ($16000 – $4200) x 6/12] = $ 1180

NCA that was used the whole year

[20% x ($16000 – $4200)] = $2360

New NCA

[20% x $5000 x 6/12] = $500

Bringing it all together!

Final answer: $1180 + $2360 + $500 = $4040

Now that we have the final answer for depreciation expense, we can move onto calculating the gain/loss on sale of asset.

Gain or loss on sale of NCA

In order to calculate the total gain/loss, you have to know what’s the total accumulated depreciation of the asset at this point. I’d suggest pausing here and then giving the question a quick go. Click on the button below to see the answer.

Answer to gain or loss on sale

Accumulated depreciation of the sold asset = $4200 + $1180 = $5380

So with that, we can calculate the NBV of the NCA which is:

$16000-$5380 = $10620

Remember that we need to compare the NBV to the amount received.

Since we received $15000 but our NBV is $10620, we made a GAIN of $4380

Hopefully this explanation was clear. Sign up to the email list on the site so you don't miss out on new posts covering tricky topics for POA :)